A Snapshot of Growth, Opportunity & Investment in the Park City Area – Q1 2025

Market Overview

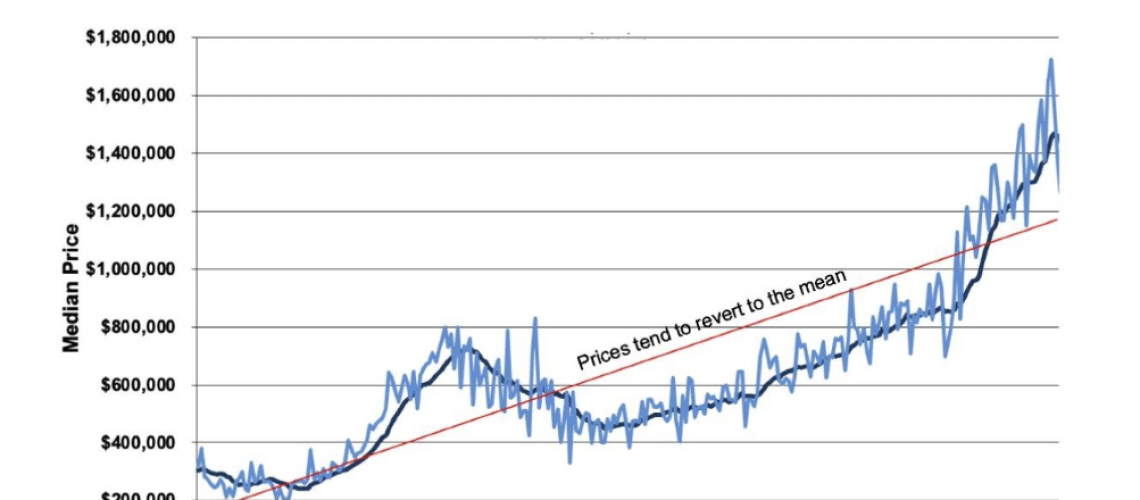

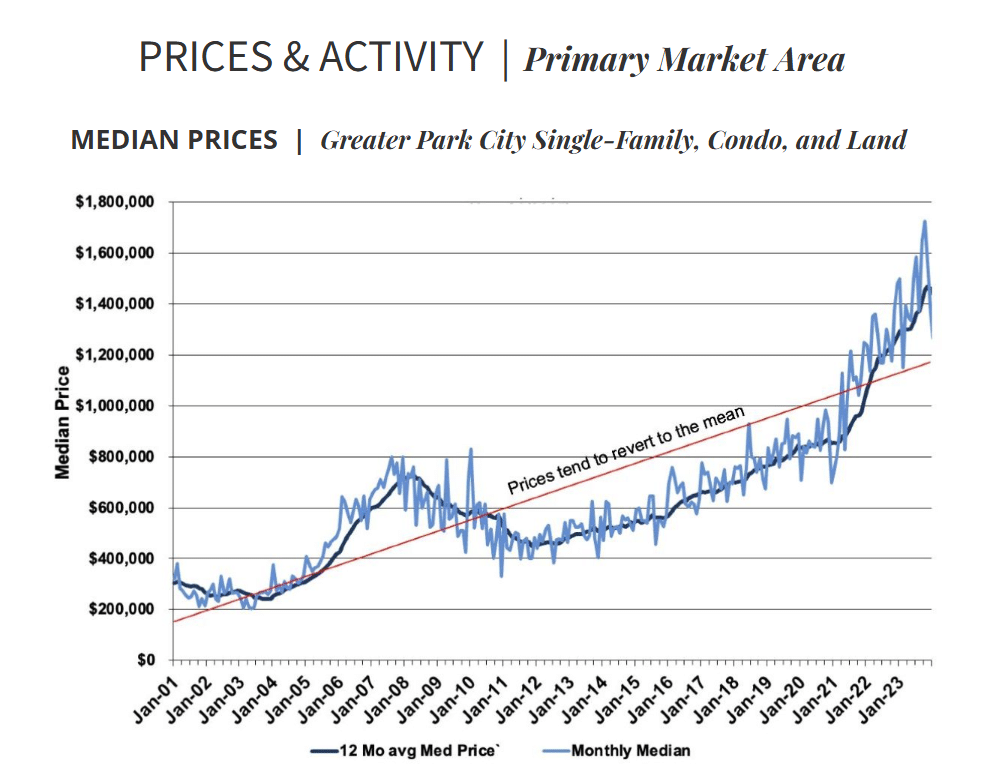

The latest stats from the Park City MLS were recently released, and they indicate continued stability in our local real estate market here in Park City and the Wasatch Back. Through the 1st Quarter of 2025, we experienced steady sales growth and stable inventory across the overall market area. Following the volatility of the pandemic years, our market appears to have settled into its normal seasonal patterns.

While national economic conditions— particularly tariffs and interest rates—remain in focus, Park City continues to be viewed as a safe and resilient investment. As stock markets fluctuate, more investors are turning to real estate in lifestyle-driven markets like Park City for long-term value, personal use, and portfolio diversification.

Inventory remains approximately one-third lower than pre-2020 levels. However, this appears to be the new normal, supporting current price stability across most segments

Market Stats – Q1 2025

Single Family Trends

Across the primary market area of both Summit and Wasatch counties, year-over-year single-family home sales activity was strong through the 1st Quarter of 2025. There were 1,042 sales, representing a 19% increase over the prior year. This led to a 21% increase in sales volume—$2.75 billion! Median single-family home prices remained flat at $1.66M, a 0.7% decrease compared to the year prior.

Condominium Trends

Condominium sales and prices across the primary market area tracked closely with those for single-family homes. There were 955 sales transactions through the first quarter of 2025, which was a 19% increase year-over-year. Total sales volume was up 30% to $1.54B, with an average price increase of 9% to $1.6M, and the median price increased 1% to $1.15M.

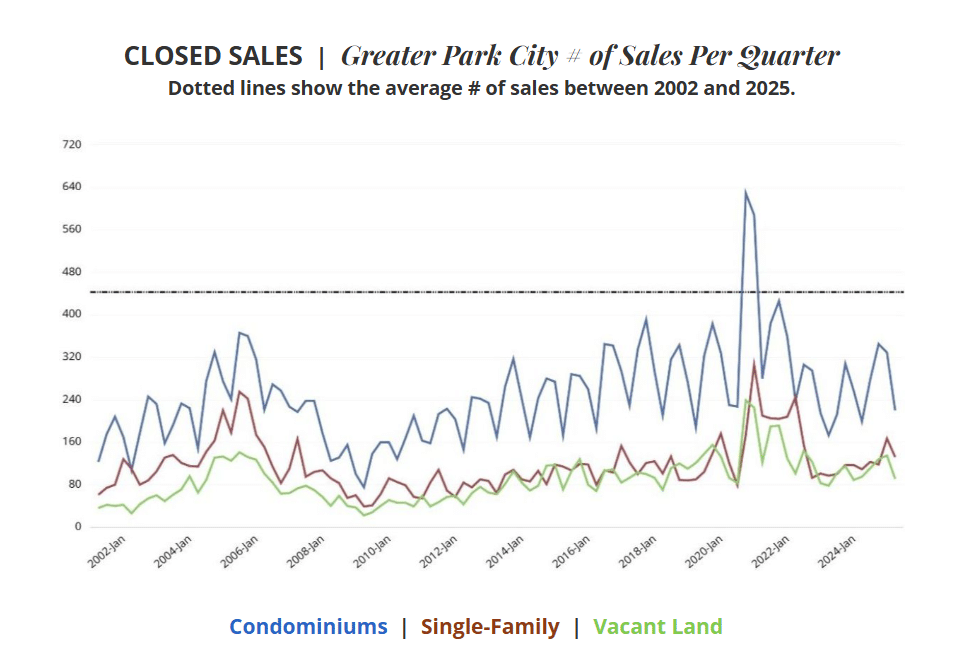

# ACTIVE LISTINGS | SF + Condos + Land

Greater Park City - Inventory as of the 1st of the Month

Total active listings at the end of the first quarter of 2025 were nearly identical to the year prior. However, it is noteworthy that single-family listings are up roughly 30% while vacant land listings have decreased almost the same amount, down 29%.

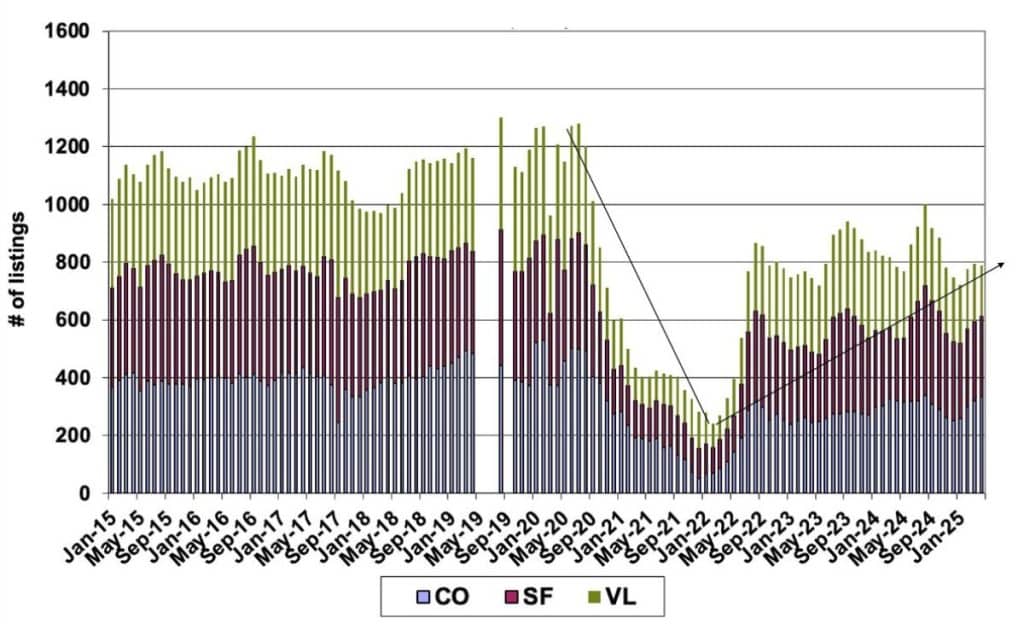

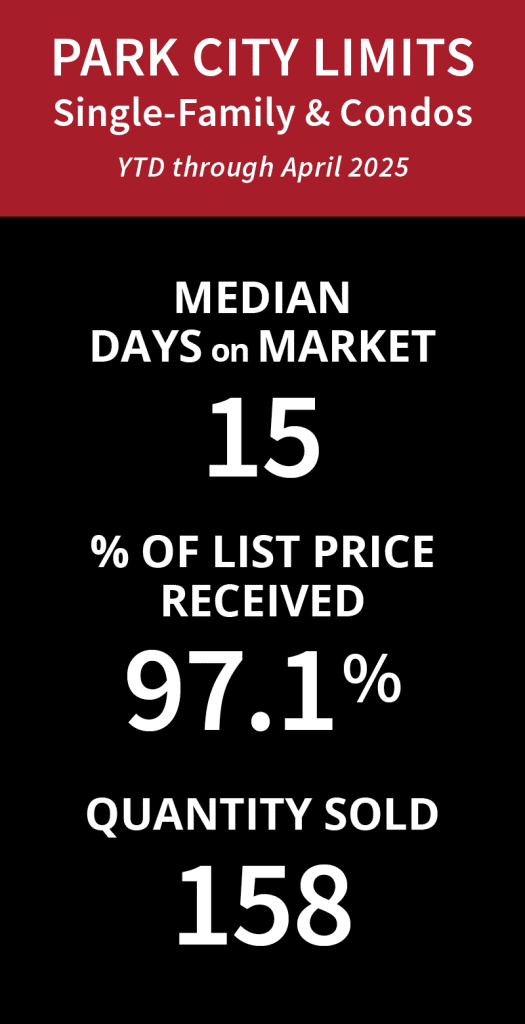

PARK CITY LIMITS I Market Overview

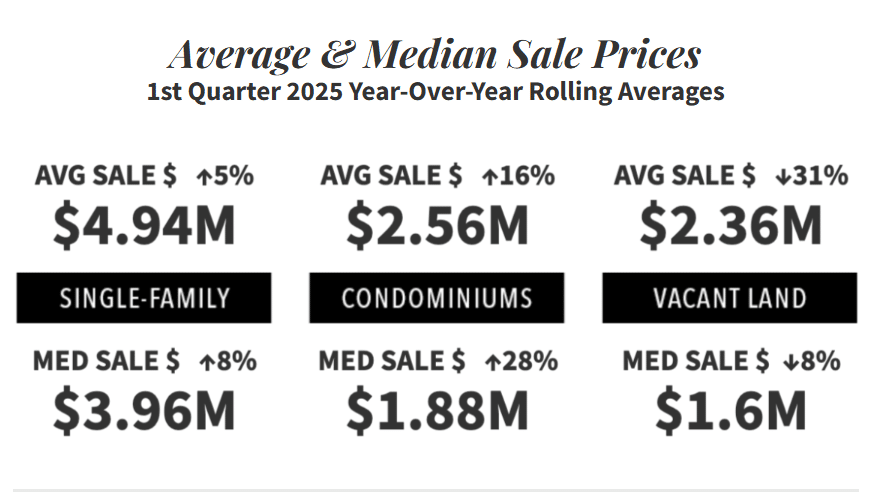

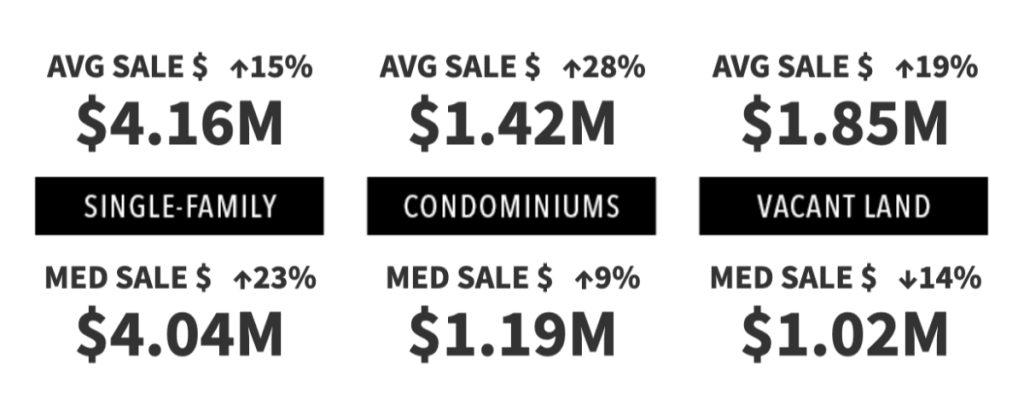

Average Median Sale Prices

1st Quarter 2025 Year-Over-Year Rolling Averages

Neighborhood Highlights - Park City Limits

SINGLE-FAMILY Homes

Within Park City limits, total unit sales were up 12% with 124 units sold, while sales volume increased 17%. The median price of a single-family home within Park City limits rose 8% to $3.96M. Only 34 homes sold in the popular Old Town area in the 12 months preceding the end of the 1st Quarter of 2025, with the median price dipping 4% to $3.6 million. Park Meadows closed sales were up 7% with 32 homes sold, and the median price was up 18% to $3.68M. Thaynes Canyon had a 150% increase in sales with 15 total closings, with a median price up 21% to $4.6M. Lower Deer Valley had 8 total sales and a median price decrease of 2% to $4.495M, while Deer Crest had 7 total sales with an 11% increase in median price to $12M. Prospector unit sales were down 7%, with 14 homes sold on a 10% increase in median price to $2.19M.

Condominiums

Condominium unit sales in Park City limits increased 12% with 268 closed sales, while the median sale price was up 28% to $1.88M. Sales in Old Town were down 10% with 93 closings, while the median price ticked up 2% to $1.2M. Deer Crest sales boomed 343% on 31 closings, with a median price increase of 2% to $4.24M. Lower Deer Valley had a 36% increase in sales to 34 units, and the median price rose a slight 1% to $2.19M. In Upper Deer Valley, unit sales were down 9% with 20 total closings, but the median price soared 82% to $4.195M. Empire Pass sales were up 4% on 25 total closings, with a 17% increase in median price to 5.4M. Prospector‘s unit sales were flat on 36 closings, with the median price down 2% to $379K. Park Meadows sales activity increased 27% on 28 total closings, with the median price dropping 17% to $1.45M.

Q1 Record Sale

254 White Pine Canyon Road in The Colony, listed at $50M, sold after 153 days on market for an undisclosed sales price. The Colony remains Park City’s premier ski-in/ski-out gated community with large estate lots averaging 5+ acres.

Listing Courtesy of KW Park City

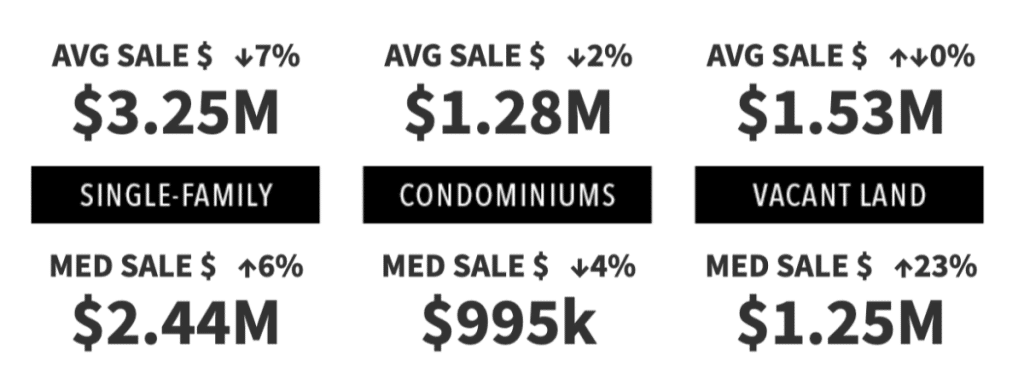

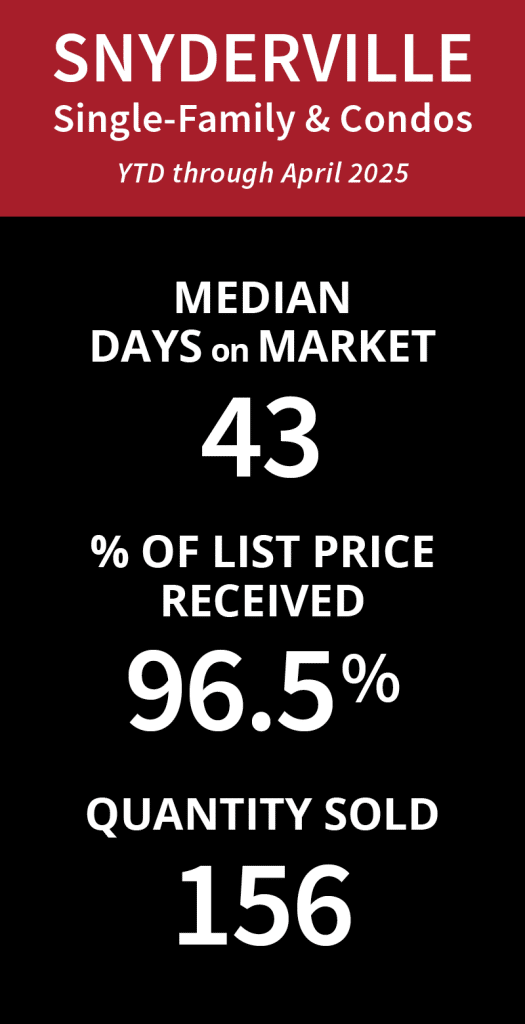

Neighborhood Highlights - Snyderville Basin

SINGLE-FAMILY Homes

The Snyderville sales units were up 24% with 346 closings, and a median price increase of 6% to $ 2.44 M. However, when we look closer, we see that Snyderville Basin again demonstrates the wide variance we have between and within neighborhoods around Park City. Of the 346 sales in the basin, the highest price was $27.8 million, nearly twice the second priciest sale, while the lowest was $760,000. Eleven sales were under $1 million, mostly in Summit Park and Kimball Junction near I-80. Ten were above $10 million, with three each falling in Promontory, Canyons Village, and Old Ranch Road, all on lots of 5 acres or more.

Glenwild was one of the hot spots with unit sales up 110% on 21 closings, led by interest around the golf course. Despite the sales activity, the median price dipped 10% to $ 5.06 M. Silver Creek Estates sales boomed 214% on 22 closings as homeowners cashed in on a 42% rise in the median price to over $2.57 million. Promontory sales were up 9% on 87 closings, with a 4% decrease in median price to $ 4.2 M. Old Ranch Road sales were up 80% with 9 closings and a robust median price increase of 46% to $ 5.9 M.

Sun Peak/Bear Hollow saw an 18% increase in unit sales with 13 closings, while the median price dropped 8% to $ 2.26 M. Jeremy Ranch sales units increased 5% with 41 units sold and a median price increase of 10% to $1.9M, while Pinebrook sales increased 55% with 34 closings on a flat median price of $1.75M. Summit Park unit sales increased 50% with 30 closings, but the median price was down 12% to $ 1.24 M. Trailside Park closings were flat with 16 sales, and the median price increased 11% to $ 1.77 M. Silver Creek South unit sales increased 29% with 27 closings, and the median price dropped 9% to $1.1M. Single-family home sales in Canyons Village were down 50% with only 6 closings, and the median price was down 7% to $ 9.85 M.

Condominiums

|

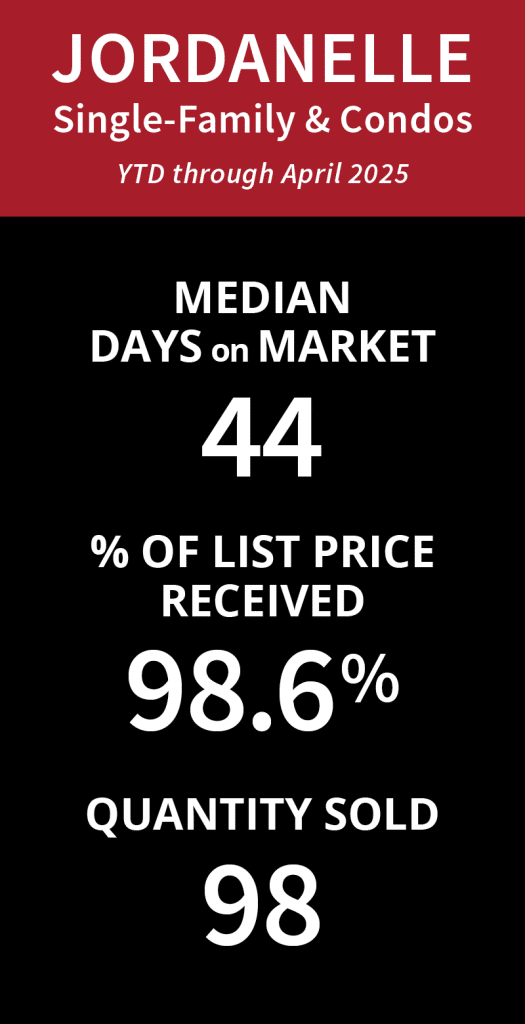

Neighborhood Highlights - Jordanelle

SINGLE-FAMILY Homes

Jordanelle had 84 total closings, an 11% increase from the previous twelve month period, and the median price jumped 23% to $4.04M. Tuhaye saw a large jump in prices, with the median price up 41% to $5.63M on 21 closings (down22%). Hideout experienced a 50% increase in sales activity with 21 total sales and also enjoyed an 15% increase in median price to $2.55M. Deer Mountain closings were flat with 10 units sold, but the median price rose 47% to $3.11M. Mayflower-Jordanelle had 9 closings with a median price increase of 28% to $4.05M, and South Jordanelle‘s unit sales were up 35% with 23 closings and a median uptick of 6% to $4.2M.

Condominiums

The condominium market around the Jordanelle provides a great example of the nuances in our local real estate market. While the Jordanelle sales volume increased 56% year over year, the median sale price rose only 9%. The reason for this disparity is that a large share of the condo sales in the Jordanelle were newly-constructed units in the Pioche Village development,

which sold at an average price of $550k, which is one-third of the overall area average. This was balanced to some degree by sales in the new developments at Mayflower Lakeside that sold on average at $1.6 million. There were 102 total sales in Deer Valley’s East Village on a median price of $959K and an average price of $1.54M.

Elsewhere around Jordanelle, sales units in Deer Mountain were down 16% with 47 closings, and median prices dropped 9% to $998K. Hideout sales units were down 7% with 67 total, and the median price was up 9% to $1.45M. In Jordanelle Park closings were down 22% with 95 units sold, with a 10% rise in median price to $1.25M.

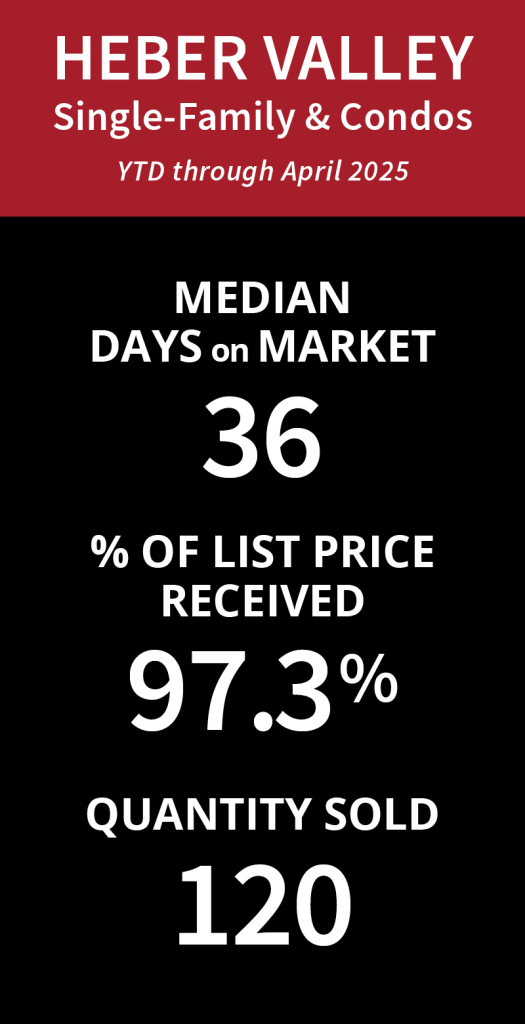

Neighborhood Highlights - Heber Valley

SINGLE-FAMILY Homes

Heber Valley continued to be a hot area, with an 11% increase in sales to 322 units, with a relatively modest 6% increase in median price to just over $1 million. The Heber area is forecast to continue its growth trajectory in the years to come due to multiple construction projects of new homes north of town.

Midway closings were up 24% with 88 units sold, on a slight median price decrease of 3% to $1.16M. Red Ledges sales units were unchanged, with 39 total closings, on a 10% median price increase to $3.3M. Heber Proper experienced a 32% decrease in sales, with 68 homes sold. Median sale prices were up 1% to $755k. Heber East sales units were up 19% on 31 total closings, and the median price rose 20% to $1.4M. Heber North was active with closings up 56% on 28 sales, and a median price decrease of 4% to $798K. Timberlakes closings were up 92% with 48 total sales, and median prices dipped 3% to $802K.

Condominiums

|

This report has been created in cooperation with KW Park City Keller Williams Real Estate with stats provided by Rick Klein and the Park City Multiple Listing Service Quarter 3 2024 Statistics Report.