Q4 & Year-End Statistics for Park City & the Wasatch Back

The 2025 year-end statistics for the Park City real estate market and the greater Wasatch Back have been released, and the numbers demonstrate continued strength and stability for our market.

That said, when viewed holistically, the Greater Park City market remains stable, consistent, and fully normalized following the volatility of the COVID era, with long-term appreciation continuing to outperform both state and national benchmarks. In short, our market had a very strong 2025, and conditions look promising as we head into the new year.

2025 Park City Market at a Glance

• $5.75 billion in total combined sales volume for single-family homes and condominiums

→ Second-highest annual total on record

• Inventory at its highest level since 2020

• 5.2 months of supply (balanced market conditions)

The combination of strong unit sales and meaningful price appreciation drove total volume higher, while expanding inventory helped restore a healthier balance between buyers and sellers.

One key takeaway from last year was that sales varied meaningfully based on property age, amenities, location, price tier, and property type, with factors like ski-in/ski-out access or golf memberships driving substantial value differences. The role of new construction has been especially important to our market, with new home sales continuing to contribute significantly to overall unit sales totals and price increases, especially in Jordanelle and the Heber Valley.

For a broader overview of available properties, visit → Park City Real Estate

Key Market Trends shaping Q4 2025

Prices & Activity I Park City Proper

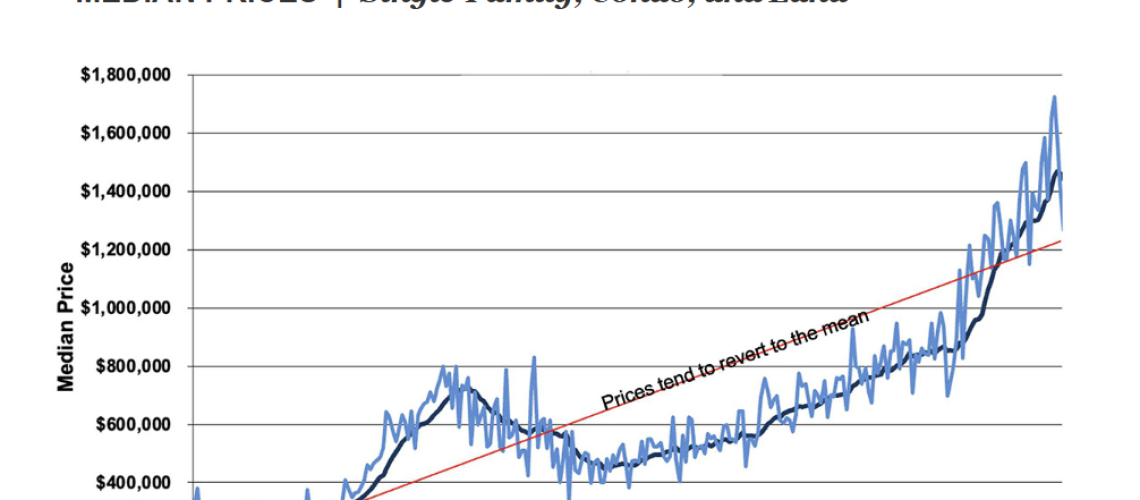

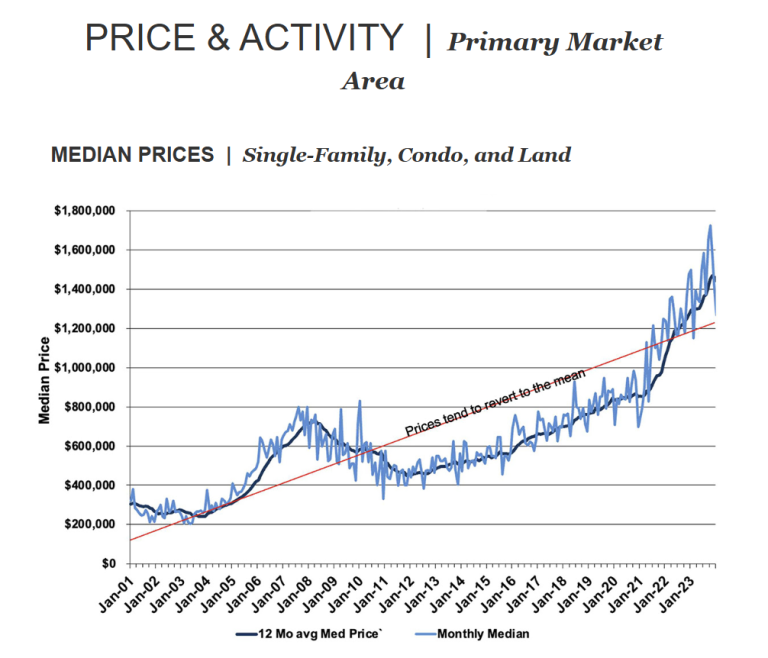

Long-Term Appreciation Trends in Park City

Since January 2001, Park City home values have appreciated at an average annual rate of 7.4% (compounded monthly). Following the 2012 market trough, appreciation accelerated to over 10% annually, outperforming both Utah and national benchmarks.

While short-term fluctuations are normal, long-term fundamentals remain strong due to:

• Limited land supply

• Strong second-home demand

• Continued resort investment

• Deer Valley East Village expansion

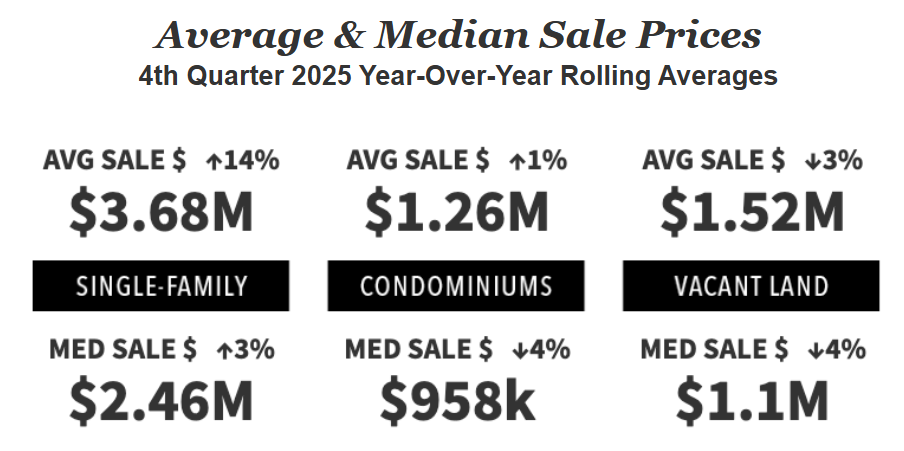

Single-Family Home Market Trends - 2025

Across the primary market area of both Summit and Wasatch counties, year-over-year single-family home sales activity was solid through 2025. There were 1,085 sales, representing a 6% increase over the prior year. Sales volume was strong, with over $3.2 billion in total transactions, representing a 26% increase over 2024. The average sales price rose 18% to $2.99 million, while the median price increased 19% to $1.96 million.

The pricing gap between new or updated homes and older inventory widened in 2025. Buyers consistently paid premiums for turnkey, move-in-ready properties — particularly in ski-access and golf communities.

Explore current inventory here → Park City Homes for Sale

Condominium Market Trends - 2025

Condominium activity showed mixed but generally strong performance. Condominium sales during 2025 were down 9% across the primary market area, with 859 closings. However, total sales volume was up 20% to $1.62 billion, with average sales price up 32% to $1.89 million and median price up 7% to $1.17 million.

Demand remained strongest in:

• Ski-in/ski-out locations

• New construction developments

• Resort-style amenity communities

See Deer Valley condos here → Park City Condos

Vacant Land Market - Fewer Sales, Premium Pricing

Vacant land sales in the primary market area were down 11% year-over-year during 2025, with 410 closed transactions. The total volume for that period was down 14% to $519 million. The average price was down 3% to $1.26 million; however, the median price increased 13% to $905,500.

Despite the reduced sales activity in our vacant land market in 2025, demand remains especially strong for lots in gated communities with attached golf club memberships, as agents observed these properties commanding $800,000-$1 million premiums over comparable lots lacking golf options.

Who is Buying and Selling?

Buyer Profile

Park City’s leading agents reported a demographic shift, with younger buyers becoming more active, particularly in Old Town. Out-of-state demand also remains strong, with many buyers relocating full-time rather than purchasing second homes. Buyers cite newer housing stock, improved access, and a more modern design aesthetic as key reasons Park City continues to outperform other resort markets. Price sensitivity persists, however, with many opting for smaller homes to stay within budget, pushing price-per-square-foot higher even as overall purchase prices remain lower in select segments.

Buyer Profile

In line with a national trend expected to accelerate, sellers are skewing older – largely baby boomers – while buyers are increasingly younger. Gen X and millennials are set to inherit nearly $2.4 trillion in U.S. real estate over the next decade, with many selling family homes to purchase properties that better fit their needs. Some sellers also point to declining rental income and rising costs, particularly for nightly rentals. The impact of the Sundance Film Festival’s departure from Park City on the short-term rental market remains unclear.

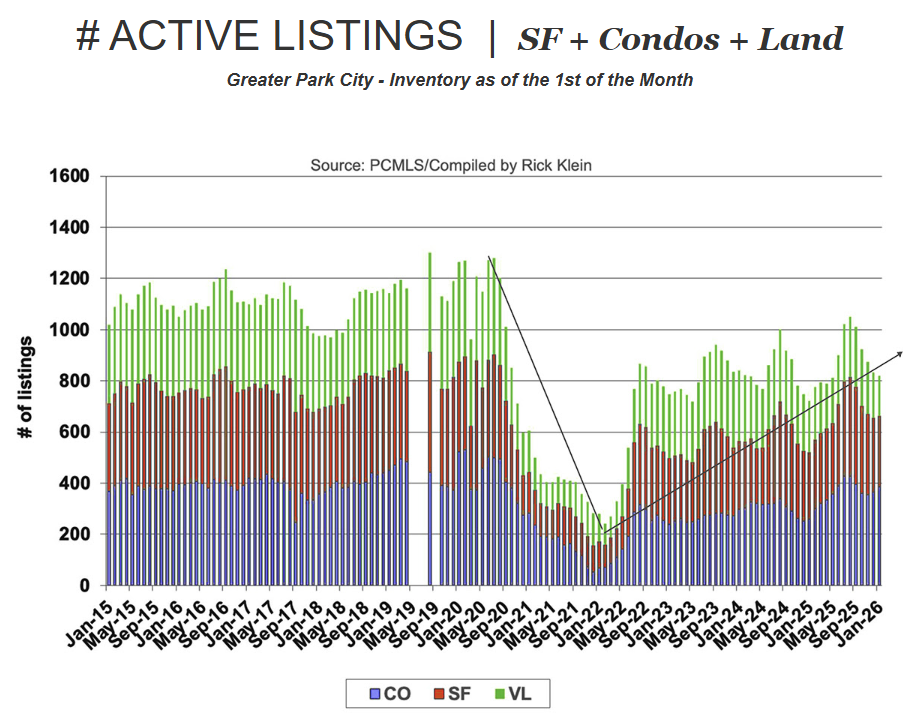

Inventory Levels: Highest Since 2020

There were 819 listings as of January 2026 compared to 721 as of January 2025, a 14% increase over last year.

# ACTIVE LISTINGS | SF + Condos + Land

Greater Park City - Inventory as of the 1st of the Month

Supply conditions continued to strengthen throughout 2025. Active listings in January were up 14% year-over-year, and average inventory levels reached their highest point since 2020.

Inventory changes year-over-year during 2025 were as follows:

• Single-family inventory was up 6%

• Condominium inventory was up 48%

• Vacant land inventory was down 21%

The market remained largely balanced, with an overall absorption rate of 5.2 months. Homes priced below the median continued to sell more quickly, while higher-priced properties—particularly at the ultra-luxury level—experienced longer days on market.

New construction played a major role in shaping inventory. While it is expected that newly built homes make up the majority of Jordanelle listings (60%), it was notable that more than 40% of listings in the Heber Valley were also new construction, signaling a quiet but meaningful shift in inventory across several sub-markets.

Q4 Record Sale

314 White Pine Canyon Road

Stunning ski-in/ski-out new construction on 10 acres in the gated community of The Colony at White Pine Canyon, this 10,756-square-foot contemporary mountain home offers direct access to the No Name ski run, spa-level amenities including a sauna and steam room, oxygenated primary suites, and more than 6,200 square feet of heated outdoor living space designed for year-round mountain living.

Listing Courtesy of BHHS Utah Properties

Park City Real Estate Market Trends by Neighborhood

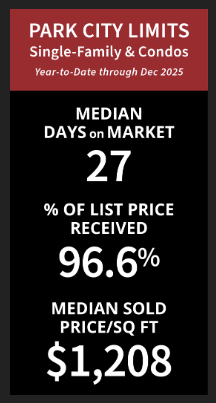

Park City Limits I Market Overview

SINGLE-FAMILY Homes

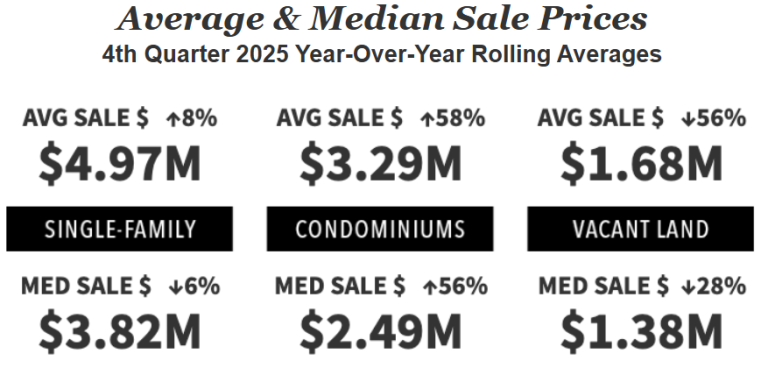

Within Park City limits, the median home price dipped 6% to $3.8 million on 143 total closings – a 29% increase in sales activity. Old Town had 53 home sales during 2025, up 56% from the previous year, while the median price dropped 9% to $3.4 million. In Thaynes Canyon, 8 homes closed with a median price of $4.8 million, up 7% over the prior year. Lower Deer Valley experienced a 1% decline in median price to $4.3 million on 8 total sales, while Deer Crest recorded 4 closings with the median price remaining flat at $12 million. Upper Deer Valley had 4 closings and a 4% increase in median price to $7.4 million.

In contrast, Empire Pass surged with 10 closed sales that pushed the median price up 12% to $14.5 million. Aerie had 4 closings with the median price down 1% to $5.0 million, while Prospector’s 17 total sales led to a 9% increase in median price to $2.2 million. Rounding out the area, Park Meadows recorded 35 closings, up 40%, with a slight 2% dip in median price to $3.3 million.

Condominiums

The market for condominiums within Park City limits remained very strong during 2025. Sales were up 17% on 284 total closings, and the median price climbed by 56% to $2.49 million. Old Town closed sales declined 10% with 86 closings, and the median price dipped 8% to $1.1 million. In Lower Deer Valley, sales rose 69% with 54 closings, accompanied by a 27% increase in median price to $2.8 million. Deer Crest experienced a dramatic surge, driven by new inventory. Sales jumped 960% to 53 closings, with the median price up 27% to $5.2 million. Upper Deer Valley also performed well, with sales up 22% on 22 closings and a remarkable 84% increase in median price to $4.9 million. Empire Pass finished the year with 21 total closings, and the median price rose 23% to $6.3 million. Prospector saw a slowdown, with a 60% drop in sales to 17 closings, but the median price increased 37% to $520K. Park Meadows posted a 3% decrease in closings with 29 total sales, and the median price fell 22% to $1.3 million.

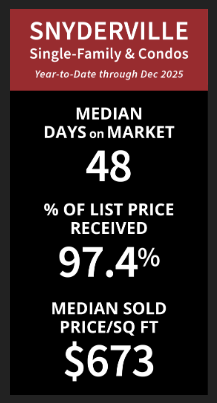

Neighborhood Highlights - Snyderville Basin

SINGLE-FAMILY Homes

It was a big year for single-family home sales in Canyons Village, where 10 homes were sold for a median price of $17.2 million, representing an increase of 144%. Sun Peak/Bear Hollow had 14 closings with a robust 42% increase in median price to $3.2 million. Silver Springs had 20 sales with a 10% rise in median price to $2.4 million, while Old Ranch Road climbed 7% to $6.3 million on 9 transactions.

Kimball Junction was active with 14 closings and a 10% gain in median price to $1.25 million. Further east, Pinebrook recorded 25 closings with a 9% increase to $1.9 million, and Jeremy Ranch logged 43 closings with a 12% rise to $2.1 million.

Summit Park had 34 closed sales with a slight 2% median sale price increase to $1.2 million. Glenwild posted 16 sales with a slight 4% dip in median price to $5.1 million, while nearby Silver Creek Estates experienced a 2% decrease to $2.5 million on 18 closings. Trailside Park recorded 20 closed sales with a 7% rise in median price to $1.6 million, and Silver Creek South had 28 sales with a 6% decrease in median price to $1.0 million. Promontory remained one of the most active neighborhoods in the Basin with 111 total closings, though its median price ticked down 2% to $4.3 million.

Condominiums

Condominium sales in the Snyderville Basin dipped slightly in 2025, down 14% with 228 total closings, and the median price declined 4% to $958,750. Canyons Village activity was down 22% on 98 closings, but the median price increased 18% to $1.3 million. Sun Peak/Bear Hollow had 23 sales and a 12% increase in median price to $1.1 million. Kimball recorded 45 sales but saw a 6% drop in median price to $739,000, while Pinebrook had 30 closings and an 11% dip in median price to $882,500. Jeremy Ranch registered 11 condominium sales at a median of $1.1 million, down 12%, and Silver Creek South had 16 closings with a 14% decrease in median price to $872,500.

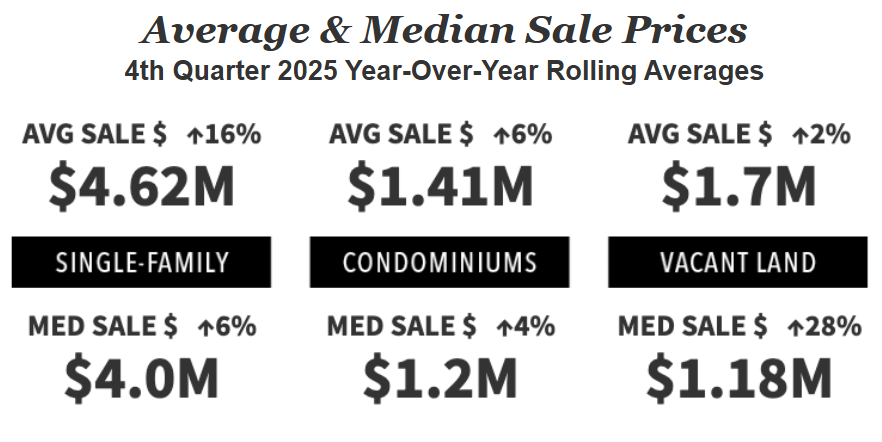

Neighborhood Highlights - Jordanelle

SINGLE-FAMILY Homes

Across the greater Jordanelle area, new construction activity continued to drive sales. There were 110 total closings during 2025, a 25% increase over the prior year, with the median price rising 6% to $4.0 million.

Mayflower-Jordanelle recorded 15 sales and an 8% median price increase to $4 million. Tuhaye posted a 17% jump in median price to $5.9 million on 29 closings, while Hideout logged 25 sales with a 10% rise in median price to $2.7 million. Deer Mountain saw 9 closings and a 30% decline in median price to $1.7 million. Rounding out the area, South Jordanelle registered 31 sales and a 2% uptick in median price to $4.2 million.

Condominiums

New development activity at Jordanelle Ridge and Mayflower Lakeside helped drive unit sales in the Jordanelle area, though pricing varied widely by project. Sale prices across several of the most active developments reflected this range – Mayflower Lakeside had 37 sales averaging $1.5 million, Pioche Village had 19 sales averaging $587,000, and Shoreline had 27 sales averaging $2.8 million.

The median price in the Mayflower–Jordanelle area climbed 22% to $1.5 million on 72 total sales. Deer Mountain recorded 51 closings but saw its median price decline 12% to $929,000. South Jordanelle followed with 12 closings and a 1% uptick to $1.1 million.

Pioche Village had 20 closings, but the median price dropped 27% to $539,000, while Hideout posted 78 closings and a 20% increase in median price to $1.6 million.

Heber Valley I Market Overview

SINGLE-FAMILY Homes

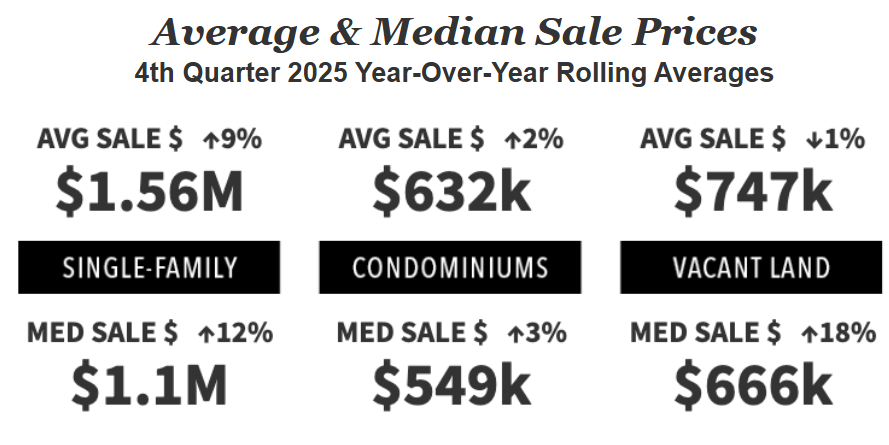

Single-family home sales across the Heber Valley rose 3% with 347 total closings, accompanied by a 12% increase in median price to $1.1 million.

Midway recorded 85 closings and a 7% median price increase to $1.2 million. Red Ledges had 55 sales, with the median price down 10% to $2.7 million. South Fields logged 13 closings and a 2% increase in median price to $743,000.

Heber proper had 69 sales with a 6% dip in median price to $719,000, while Heber East posted 35 closings and a 22% drop in median price to $1.2 million. Heber North saw 30 sales and a 7% median price increase to $862,000. Timber Lakes rounded out the area with a 2% uptick in median price to $793,000 on 34 closings

Condominiums

During 2025, the condominium market in Heber Valley posted 98 total closings, with a slight 3% increase in median price to $549,000.

Midway registered 21 closings and a 16% increase in median price to $567,000. Red Ledges recorded 8 sales and a 3% increase in median price to $1.6 million. In Heber proper, 25 sales closed with a 1% increase in median price to $479,000, while Heber North saw 41 closings with a 7% drop in median price to $549,000.

This report has been created in cooperation with KW Park City Keller Williams Real Estate, with stats provided by Rick Klein and the Park City Multiple Listing Service Quarter 4 2025 Statistics Report.

Looking Ahead to 2026

2025 turned out to be a very solid year for our local real estate market here in Park City and the Wasatch Back. With expanded inventory well beyond recent norms, steady buyer demand, and continued new construction—particularly around the Jordanelle and East Village—adding new supply, our market fundamentals point to continued stability. Even modest interest rate improvements could make 2026 another strong year for the Greater Park City real estate market.

Curious how These trends affect your property or buying strategy?

If you have questions about your neighborhood, property type, or timing considerations for buying or selling in 2026, we’re always happy to help.

Call Drew Via & Annett Blankenship

The Park City Investor Team

KW Park City – Keller Williams Real Estate

435.640.6966