The Perfect Ski Retreat: Explore Westgate #3912 A&B

Ski Condo for Sale at Westgate Park City, Utah Experience the pinnacle of luxury in this meticulously renovated Westgate Penthouse, comfortably accommodating up to 8

Ski Condo for Sale at Westgate Park City, Utah Experience the pinnacle of luxury in this meticulously renovated Westgate Penthouse, comfortably accommodating up to 8

New Release: The Residences at Indi Ridge The recent release of the Residences at Indi Ridge marks the final phase of developer-built homes in Tuhaye.

Sommet Blanc – Luxury New Ski Condos in Empire Pass Real Estate in Empire Pass remains in high demand. With limited inventory, buyers are still

5 bedrooms I 4 baths I 4,177 SF I 0.33 AcresList Price: $2,850,000 This custom 5-bed, 4-bath residence offers the perfect blend of luxury, comfort,

The New Deer Valley East Village Deer Valley Resort and Extell Development Company just disclosed that the name for their new base village and portal

2273 Perches Drive I Golden Eagle at Hideout This 0.88-acre lot is a fantastic corner lot steps from open space. It allows for an easy

Pioche Village Deer Valley Pioche Village is conveniently situated near the Deer Valley Resort Jordanelle Express Gondola, below Deer Crest and close to the Mayflower

Multi-level Garage to Replace Cabriolet Lot TCFC, the master developer of Canyons Village, has recently unveiled plans for a new multi-level garage that will offer

The snow has been flying at the upper elevations this past week, turning our thoughts from autumn to winter. Get Ready! _______ WASATCH BACK _______

The International Olympics Committee, meeting in Mumbai, India, has made Salt Lake City the only candidate for the Winter Games in 2034, the body announced

A Red Ledges Discovery Stay is the best way to learn about the Community If you are looking to live in a gated golf and

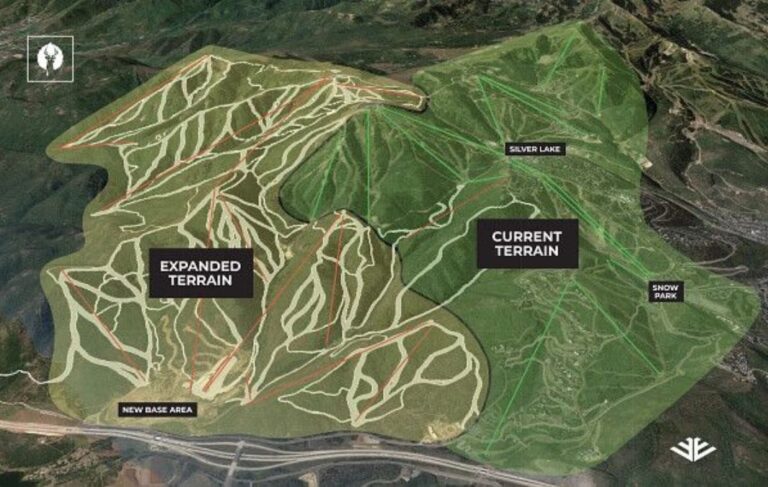

It is official! Deer Valley Resort, owned by Alterra Mountain Company, and Extell, the developer of Mayflower Mountain Resort, have finally come to an agreement

Website is hosted by Realtyna